您好,欢迎光临EasyGo易游国际,我们提供全球【签证办理】【移民绿卡】【机票预订】【公证认证】【法律支援】【商标注册】等各国出入境服务

THE OFFICIAL PARTNER

HOT LINE

19896549345

中文 / English

Complete List of Filipino Company Registration Types? Those who want to register a company in the Ph

Most Chinese enterprises need at least three months to half a year to do business investigation and market environment research when they come to the Philippines for exhibition.

On the premise of full confidence in the market and business, company registration is the basis for ensuring the legality and compliance of all businesses. After the completion of other special permission applications, what types of companies are there? What are the differences between different types?

01. Company type?

1.Sole proprietorship

Sole proprietorship: The ownership of the enterprise is owned by the founder, who has full control and responsibility over the enterprise, and assumes and owns assets and liabilities Must be registered in an individual's name.

Excellent: short time, low cost;

Inferior: not for sale, not for transfer, unlimited liability, and not for registration of foreigners;

2. Partnership

Such companies usually appear in professional firms and can be handled by two partners with corresponding licenses. Such as lawyer's office and architect's office.

3. Joint stock limited company

⚫ Traditional joint-stock company with five or more shareholders: First of all, it allows foreigners to participate in the company, but for this shareholder, most of them need to have the Philippine nationality or local permanent residency.

As for the right of permanent residence, 13A visa, or special retirement visa or investment visa are common for Chinese. These types of visas belong to the right of permanent residence.

⚫ The newly opened joint-stock limited company with less than five members: this type has no requirements for the type of shareholder visa, and the number of shareholders can be registered flexibly according to the actual situation, even if there are only two, two, three or four shareholders.

For a joint-stock limited company, if the Filipino does not hold shares, or if the Filipino does not hold 60% of the shares, it is a foreign-funded company. Of course, this includes the situation that the 100% Chinese holds. In this case, the government requires that the registered capital be up to 200000 dollars (there is no actual capital verification process for the part of the registered capital), This requirement on registered capital will affect the early registration cost. The higher the registered capital, the higher the registration cost.

⚫ One person company (OPC):

(One Person Corporation) One person company OPC, also known as the sole proprietorship company, passed an act on May 6, 2019. Except for industries that are prohibited from foreign investment by the Constitution and laws of the Philippines, foreigners can establish a company by one person. Please note that it is a "limited liability company".

Excellent: foreigners can apply, applicants have no visa requirements, can be fully controlled, and have no capital verification requirements;

Poor: 2 additional prospective successors are required, 3 passports in total, and the company name suffix is OPC.

02. Type of foreign capital?

Category introduction of "foreign companies" in the Philippines; A foreign company is a company established and registered in accordance with the Foreign Investments Act of the Philippines.

representative office

Definition: The overseas office is dominated by the foreign parent company and the parent company has been established according to the foreign laws to establish an office in the Philippines.

The minimum capital of the office is 30000 dollars, and no income is allowed.

It is not an independent legal person in the Philippines, but a temporary representative office dispatched by the parent company in the Philippines.

Only market research, brand promotion and after-sales service can be carried out

branch office

Definition: Those who already have companies outside the Philippines want to set up branches in the Philippines.

The tax burden is based on the income of the Philippines, and the minimum registered capital is 200000 US dollars.

It is not an independent legal person in the Philippines, but the parent company is fully controlled and operates in the Philippines.

The business scope shall be completely consistent with that of

the parent company.

Foreign independent subsidiary

Definition: Domestic legal persons with foreign investment ratio exceeding 40%.

The tax burden is based on all domestic and foreign income.

If the parent company holds shares, the legal person needs to be a natural person and has no legal affiliation with the parent company.

It may be inconsistent with the business scope of the parent company.

03. Four Steps to Complete Registration

4 Steps to Complete Company Registration

Register the company name with the Securities and Exchange Commission (SEC) or DTI;

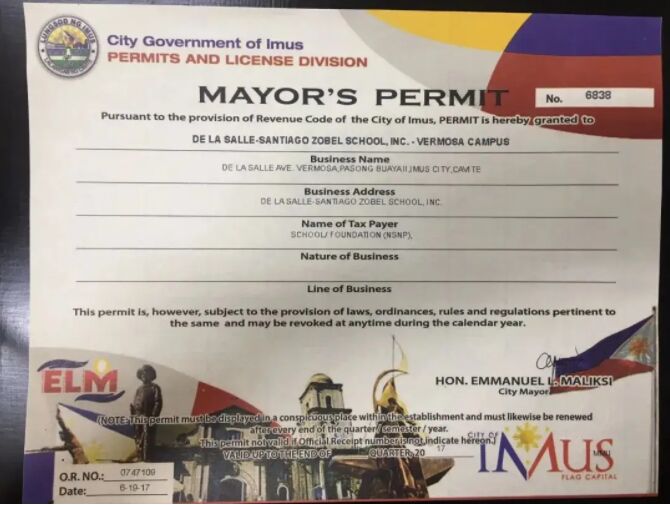

Register with local government authorities (LGU's) and apply for business licenses. Different cities and towns need to apply for registration with the local government (BARANGAY (BRGY))&City Hall;

Provide BIR (Bureau of Internal Revenue) with registration license and request approval for establishment;

Apply for employee related benefits from different government agencies.

(Social Insurance Bureau, Philippine Health Insurance Bureau, Housing Provident Fund)

04. Special permission?

What industries require special licenses

If the company is engaged in a special industry, it needs to apply for a special industry license after the company registration is completed.

Common industries are listed below:

⚫ Special standard license for manufacturer's production line

⚫ ICC quality mark to ensure that imported consumer goods meet Philippine standards

⚫ Export license

⚫ Enterprises involved in the production and sales of food, cosmetics, drugs, toys and other products

⚫ Tourists (including hotels and tourists)

⚫ Mass transport operation

⚫ Communication industry

⚫ Payment and financial industry

⚫ mineral products

⚫ construction industry

⚫ media

⚫ Partnership companies with professional licenses (such as law firms, accounting and auditing firms, architectural firms, etc.)

⚫ Hospitals or clinics, pharmacies, etc

Note: This table is for common industries but not limited to. For more information, please consult EasyGo

Relative Services

菲律宾

Philippines

VIP Price: ¥360000/人起

菲律宾

Philippines

VIP Price: ¥9495/人起

菲律宾

Philippines

VIP Price: ¥65000/人起

菲律宾

Philippines

VIP Price: ¥537500/人起

瓦努阿图

Vanuatu

VIP Price: ¥200000/人起

Popular Services

Recommend

Hot

List of holidays in Indonesia in 2023 1

Assault! Multi-sector joint raid in the Philippines! Detain the Chinese, 255 of them! 3

Sudden! 6 Chinese kidnapped by 5 in Philippines...... 4

"Chinese businessman frightened by kidnapping"? Philippine police concealed "kidnapping case"? 5

Philippines 2024 statutory holidays and special holidays (with salary algorithm) 7

Do Japanese visa holders travel to the Philippines visa-free? 8

出入境顾问 在线咨询

在线客服

在线客服

联系方式:19896549345,您可以电话或者微信直接沟通。

加我好友,随时为您解答出入境问题