您好,欢迎光临EasyGo易游国际,我们提供全球【签证办理】【移民绿卡】【机票预订】【公证认证】【法律支援】【商标注册】等各国出入境服务

THE OFFICIAL PARTNER

HOT LINE

19896549345

中文 / English

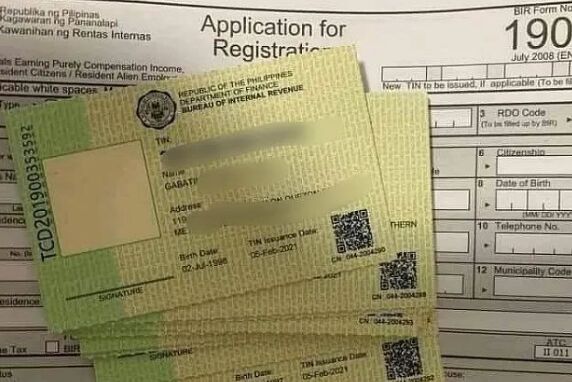

Philippine Tax Bureau Warns Taxpayers with Multiple TIN Number Violators Can Be Dened for Six Months

On May 23, local time, the Philippine Bureau of State Affairs (BIR) Director Romeo Lumagui Jr. announced that criminal charges would be filed against taxpayers with multiple Taxpayer Identification Numbers (TINs).

The official said that the taxpayer identification number plays a vital role in the tax system. It enables the tax bureau to effectively monitor and track taxpayers' compliance with their tax obligations.

To avoid other inconveniences such as criminal charges, the authorities urged individuals with multiple taxpayer identification numbers to apply to the tax district office where they are registered for the cancellation of the additional TIN number.

According to Article 275 of the Philippine Revenue Code, taxpayers should only have a taxpayer identification number, and violators can be fined 1000 pesos and imprisoned for six months.

In addition to potential criminal charges, individuals with multiple taxpayer identification numbers may experience difficulties in financial transactions, such as opening a bank account or applying for a loan.

In addition, the existence of multiple taxpayer identification numbers can lead to confusion when filing tax returns.

The Inland Revenue Department stressed the importance of complying with the regulations on taxpayer identification numbers and urged taxpayers to deal with any situation with multiple taxpayer identification numbers in a timely manner to avoid legal implications and simplify their financial affairs.

Relative Services

菲律宾

Philippines

VIP Price: ¥360000/人起

菲律宾

Philippines

VIP Price: ¥3700/人起

菲律宾

Philippines

VIP Price: ¥65000/人起

菲律宾

Philippines

VIP Price: ¥62000/人起

菲律宾

Philippines

VIP Price: ¥537500/人起

土耳其

Turkey

VIP Price: ¥1380000/人起

Popular Services

Recommend

Hot

List of holidays in Indonesia in 2023 1

Assault! Multi-sector joint raid in the Philippines! Detain the Chinese, 255 of them! 3

Sudden! 6 Chinese kidnapped by 5 in Philippines...... 4

"Chinese businessman frightened by kidnapping"? Philippine police concealed "kidnapping case"? 5

Philippines 2024 statutory holidays and special holidays (with salary algorithm) 7

Do Japanese visa holders travel to the Philippines visa-free? 8

出入境顾问 在线咨询

在线客服

在线客服

联系方式:19896549345,您可以电话或者微信直接沟通。

加我好友,随时为您解答出入境问题