您好,欢迎光临EasyGo易游国际,我们提供全球【签证办理】【移民绿卡】【机票预订】【公证认证】【法律支援】【商标注册】等各国出入境服务

THE OFFICIAL PARTNER

HOT LINE

19896549345

中文 / English

Comparison of differences between Turkish immigrants and Antigua immigration projects! Which is more suitable for you

The investment immigration program is one of the mainstream immigration methods in the world. It has been in operation for more than ten years, and thousands of applicants have immigrated overseas through investment immigration.

Turkish immigrants and Antigua immigrants are two well-known projects in the investment market, but many people do not know the differences between the two projects.

EasyGo International has compiled a comparison of Turkish immigration and Antigua immigration programs in detail, and then helps you sort out the differences between the two citizenship programs.

1. Comparison of application conditions

Turkish immigrants: no language, no residence, no explanation of the source of funds and other requirements, only need to be at least 18 years old, meet the investment conditions, can be approved Turkish citizenship in one step.

Antigua immigrants: fast and simple, no language requirements, no proof of property source, 3 to 6 months or so will be able to get an Antigua passport.

Judging from the application conditions, the two countries are comparable, and neither has the language, academic qualifications, and funding source requirements, so it is enough to make corresponding investments.

2, subsidiary applicant requirements comparison.

Turkish immigrants: The main applicant, his/her spouse and children under the age of 18 can obtain Turkish citizenship at the same time.

Antigua immigrants: may bring in dependent applicants including the spouse of the principal applicant, aged 0 to 30 years, financially dependent on the principal applicant's children, aged 18 or over, but physically or mentally disabled, living with and fully supported by the principal applicant; parents or grandparents of the principal applicant, or their spouse, aged 55 or over and financially dependent on the principal applicant; siblings of the principal applicant, or unmarried siblings of their spouses.

In terms of affiliated applicants, the Antigua immigration program should be more relaxed. It can not only bring spouses and minor children, but also adult children under 30 years old, parents over 55 years old and siblings. It is far more relaxed than Turkish immigrants and is suitable for three or even four generations of a family to immigrate together.

3. Comparison of investment funds

Turkish immigrants:

1. Purchase of property

Purchase of Turkish property: $400000 (one or more units) and hold it for three years, during which it can be rented;

2. Bank deposits

Deposit $500000 in a Turkish bank, or $500000 in bonds, denominated in the Turkish lira and held for three years.

Immigrants from Antigua:

1. Donation Options

Donations to the National Development Fund (NDF): US $100000 (1 to 4 applicants), US $125000 (5 and above);

2. Real Estate Options

A minimum of $200000/$400000 for a real estate project approved by the government as a co-investor/sole investor and maintained for five years;

3. Enterprise Options

Invest at least $1.5 million in an approved business as a single investor; or invest at least $5 million in an approved business for 2 or more joint investors, each investor must individually donate at least $400000.

From this point of view, Antigua immigrants have a wider range of investment options and lower starting prices, which can meet the needs and abilities of more people. The investment of Turkish immigrants is more relaxed and flexible. The houses they hold can be rented out, and the holding time is shorter, saving the time to get a passport.

4, can achieve capital exit.

Turkish immigrants: 3 years after buying a house to obtain citizenship, the property can be sold to achieve capital exit. Investors in newly purchased real estate can no longer apply for Turkish immigration programs. The bank deposit method can be withdrawn after 3 years.

Antigua Immigrants: The way to buy a house can be withdrawn after five years. Investors in newly purchased real estate can also apply for the Antigua Immigrant Project with this property.

In terms of capital withdrawal, Turkish immigrants and Antigua immigrants have their own strengths. Applicants can choose projects that are more suitable for them according to the situation.

5, can apply to enter the United States

Turkish immigrants: Turkey and the United States are E2 visa signatories. If you get Turkish citizenship, you can apply for a US E2 visa to enter the United States.

Antigua Immigrants: Not able to obtain a US visa.

Therefore, Turkish immigrants have an advantage if they want to use their passports as a springboard to move to the United States quickly.

6. Comparison of visa-free countries and regions

Turkish immigrants: Turkish citizens can enter 117 countries and regions with their passports, including Singapore, Japan, Hong Kong, China, etc.

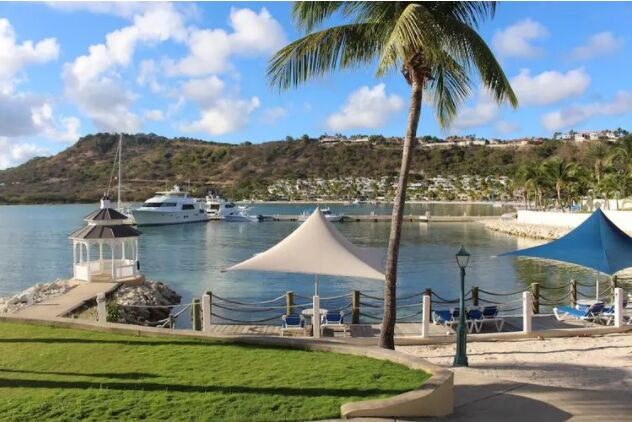

Antigua immigrants: Antigua passport can freely enter and leave the United Kingdom and other Commonwealth countries. There are 160 countries in the world, including France, Germany, Italy, Spain, Hong Kong, South Korea, Singapore, etc.

In the number of visa-free countries and regions, the Antigua passport is significantly better. If you want to travel around the world or need to travel on business, Antigua passport will be your best choice.

7. Comparison of national strength

Turkey ranks 13th in the world in terms of GDP, with a per capita GDP of $8,000.

Antigua ranks 56th in the world in terms of GDP, with a per capita GDP of $14,168.

Turkey is a country with a large population and economy, and a member of the G20, while Antigua is an upper-middle-income country dominated by agriculture and tourism.

8. Comparison of tax situation

Turkey: Turkish tax residents are required to declare their worldwide income under Turkish tax law. For non-Turkish tax residents, Turkey is not a global tax country and only needs to declare its income in Turkey, not global income. Turkish tax law stipulates that Turkish citizens who have lived in Turkey for a certain number of days automatically become tax residents. Turkish citizens residing abroad are not tax residents. As in most countries in the world, there are a series of requirements and criteria for determining the eligibility of tax residents in Turkey according to the tax law.

Antigua: Antigua is a global offshore financial center, a world-class offshore tax haven, with no capital gains tax, net assets tax, overseas income tax, inheritance tax and gift tax. Antigua citizenship to open overseas accounts, offshore companies, overseas investment, reasonable planning of assets, to ensure the safety of investors' funds.

In terms of tax planning function, Antigua, as a world-class tax haven, has a unique tax advantage over Turkey for those who want to reasonably plan their funds and invest in overseas listings.

Relative Services

菲律宾

Philippines

VIP Price: ¥360000/人起

菲律宾

Philippines

VIP Price: ¥9495/人起

菲律宾

Philippines

VIP Price: ¥3700/人起

菲律宾

Philippines

VIP Price: ¥65000/人起

菲律宾

Philippines

VIP Price: ¥537500/人起

瓦努阿图

Vanuatu

VIP Price: ¥200000/人起

土耳其

Turkey

VIP Price: ¥1380000/人起

Popular Services

Recommend

Hot

List of holidays in Indonesia in 2023 1

Assault! Multi-sector joint raid in the Philippines! Detain the Chinese, 255 of them! 3

Sudden! 6 Chinese kidnapped by 5 in Philippines...... 4

"Chinese businessman frightened by kidnapping"? Philippine police concealed "kidnapping case"? 6

Philippines 2024 statutory holidays and special holidays (with salary algorithm) 7

Do Japanese visa holders travel to the Philippines visa-free? 8

出入境顾问 在线咨询

在线客服

在线客服

联系方式:19896549345,您可以电话或者微信直接沟通。

加我好友,随时为您解答出入境问题