您好,欢迎光临EasyGo易游国际,我们提供全球【签证办理】【移民绿卡】【机票预订】【公证认证】【法律支援】【商标注册】等各国出入境服务

THE OFFICIAL PARTNER

HOT LINE

19896549345

中文 / English

Philippine House of Representatives to submit export tax bill, short-term implementation is extremely unlikely.

The Philippine House of Representatives panel approved a new fiscal system for the mining industry on August 24, 2022, which is expected to generate 37.5 billion Philippine pesos throughout the first year of implementation.

A House committee approved a bill that proposes a rationalized and single fiscal system that applies to all existing and potentially large metal mines, regardless of their location. The commission adopted the Treasury's version, which would "raise the state's effective tax rate on the mining industry, taking into account all taxes, from 38% under the current system to 51%.

Rep. Joey Salceda (R-Albay), chairman of the committee, said it would take the Philippines "closer to the middle" among the major mining countries, rather than near the bottom of the list.

"51% is a good number because it brings us closer to Australia's effective tax rate, which is also about 51% including royalties. Of the major countries, only Chile and South Africa have lower effective tax rates than ours. This proposal brings us closer to our region compared to Australia and Indonesia. China's effective tax rate on gold mines is as high as 71%," Salceda said, adding that the proposal would fulfill the panel's commitment to President Ferdinand "Bangbang" Marcos Jr. and the Ministry of Finance to raise revenues to fund the government's priority programs.

Salceda explained that according to Marcos' medium-term fiscal framework, the revenue plan assumes that tax revenue will increase by 0.3% per year in gross domestic product (GDP). "The mining tax reform has already addressed half of the assumptions. So if enacted, it would be very conducive to the greater ambition of the BBM president in terms of infrastructure, the agricultural revolution and a solid Filipino middle class," he said.

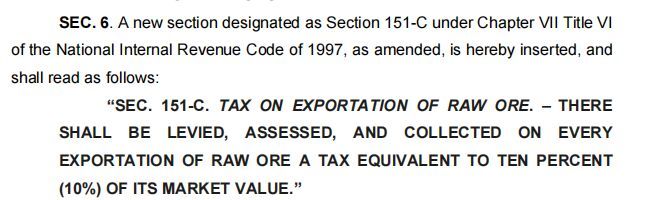

The bill proposes a 5 per cent royalty on the market value of the total output of large-scale mining operations. It also stipulates that at least the government's share of 60% of net mining revenues, including all government taxes, fees and charges, will be levied on mining operations. A 10% export tax is imposed on the market value of ore exports to encourage domestic processing of mineral products.

"Mining GVA has been declining, but the value of exports has been increasing, which shows that most exports are ores with no domestic added value. I hope to continue to communicate with stakeholders on how we can use this charge to improve the domestic mining value chain," Salceda said. He noted that each mining project would also be treated as a separate tax entity, which would help curb tax avoidance by allocating costs among related projects within the same company."

In order to institutionalize transparency standards, the Government will implement a mechanism for the public disclosure and review of all mining tax and revenue data in the extractive value chain. Salceda pointed out that such standards can help mining companies obtain cheaper and more foreign capital and technology, thus improving mining efficiency.

It is understood that a bill amendment needs to be submitted to Congress and signed by the president before it can be implemented, which generally takes 3-5 years. At present, the bill is only a proposal of the House of Representatives and has not been discussed and passed by Congress. The possibility of implementation in the short term is extremely low.

Relative Services

菲律宾

Philippines

VIP Price: ¥360000/人起

菲律宾

Philippines

VIP Price: ¥9495/人起

菲律宾

Philippines

VIP Price: ¥3700/人起

菲律宾

Philippines

VIP Price: ¥537500/人起

土耳其

Turkey

VIP Price: ¥1380000/人起

VIP Price: ¥1000/人起

Popular Services

Recommend

Hot

List of holidays in Indonesia in 2023 1

Assault! Multi-sector joint raid in the Philippines! Detain the Chinese, 255 of them! 3

Sudden! 6 Chinese kidnapped by 5 in Philippines...... 4

"Chinese businessman frightened by kidnapping"? Philippine police concealed "kidnapping case"? 5

Philippines 2024 statutory holidays and special holidays (with salary algorithm) 7

Do Japanese visa holders travel to the Philippines visa-free? 8

出入境顾问 在线咨询

在线客服

在线客服

联系方式:19896549345,您可以电话或者微信直接沟通。

加我好友,随时为您解答出入境问题