您好,欢迎光临EasyGo易游国际,我们提供全球【签证办理】【移民绿卡】【机票预订】【公证认证】【法律支援】【商标注册】等各国出入境服务

THE OFFICIAL PARTNER

HOT LINE

19896549345

中文 / English

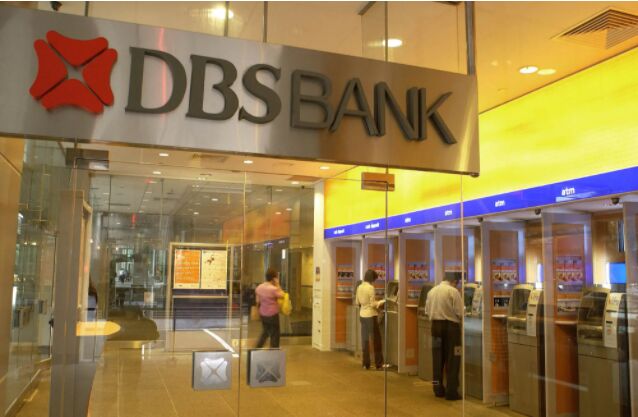

Offshore Bank | Singapore DBS Bank Account Opening Strategy

Singapore DBS Bank Profile:

DBS Bank (DBS), formerly known as Development Bank of Singapore, is the largest commercial bank in Singapore. The bank was established in 1968 as a development financing institution established by the Singapore government. Not satisfied with its status as a local flagship, it accelerated its overseas expansion in the late 2090 s, acquiring commercial banks in Thailand, the Philippines, Indonesia, Hong Kong and Taiwan, and renamed DBS Bank in 2003.

Everyone knows that the English abbreviation of DBS is DBS, and the full name is Development Bank of Singapore, Singapore Development Bank, which was controlled by Temasek as early as 1968. At the end of 1998, DBS acquired Hong Kong Guang'an Bank. The Chinese were patriotic and Hong Kong people loved Hong Kong. Suddenly, a foreign capital acquired a local bank. Naturally, it was uncomfortable. In order to avoid the resentment of Hong Kong people, DBS weakened Singapore's foreign investment as much as possible. Background, so it was renamed Hong Kong DBS Bank.

Advantages of DBS Bank in Singapore:

1. Singapore's overall financial environment is one of the best in the world. The three giants of Singapore's local banks have also won the top 10 of the world's safest banks published by Global Finance for 11 consecutive years. Among them, DBS Bank ranked first in 2021.

2. DBS Bank's investment and wealth management products are very rich, including funds, stocks, foreign exchange, fixed income and other alternative investments.

3. There are Chinese online banking and Chinese APP, which are convenient to use. Counter, cash withdrawal, credit card, online banking and wire transfer are very convenient to operate through multiple channels.

4. DBS Bank supports multiple currencies for personal account opening. In addition to the default US dollar and Singapore dollar, it also includes New Zealand dollar, Australian dollar, Japanese yen, Hong Kong dollar, euro, British pound and other currencies. Basically, everything you need can be met.

5. If the account is opened successfully, the account/transfer can be arranged, the policy is loose, and the source of funds is simple to explain. Can be offshore, online banking operation transfer, collection or consumption business.

Singapore DBS Bank Personal Account Opening Process:

After the customer confirms the service product, submit KYC and identity documents online.

After the preliminary examination determines that the qualification for opening an account is met, the customer pays.

After the bank phone confirms, send the account opening form.

The customer sends it back after receiving the signature.

Receive bank account within 15 working days or so, open account activation

Singapore DBS Bank Account Opening Information:

1. Account Opening Form (Special Account Opening Form for DBS)

2. ID card, pass/passport

3. Proof of income (including company name, customer name, identification number, date of employment, position, annual income)

4. Account opening signature document (bank mail)

Singapore bank personal accounts are suitable for the following groups of people:

1. Businessmen with cross-border trade and financial flows;

2. Investors who wish to make global plans for cross-border investment and assets;

3. Travellers living, working and studying abroad or globally;

4, want to reasonable asset planning, to ensure the safety of funds;

5. Immigrants who have an immigration plan and need to make cross-border investment transfers.

Relative Services

菲律宾

Philippines

VIP Price: ¥62000/人起

菲律宾

Philippines

VIP Price: ¥537500/人起

瓦努阿图

Vanuatu

VIP Price: ¥200000/人起

土耳其

Turkey

VIP Price: ¥1380000/人起

瓦努阿图

Vanuatu

VIP Price: ¥1020000/人起

VIP Price: ¥1000/人起

Popular Services

Recommend

Hot

List of holidays in Indonesia in 2023 1

Assault! Multi-sector joint raid in the Philippines! Detain the Chinese, 255 of them! 3

Sudden! 6 Chinese kidnapped by 5 in Philippines...... 4

"Chinese businessman frightened by kidnapping"? Philippine police concealed "kidnapping case"? 5

Philippines 2024 statutory holidays and special holidays (with salary algorithm) 7

Do Japanese visa holders travel to the Philippines visa-free? 8

出入境顾问 在线咨询

在线客服

在线客服

联系方式:19896549345,您可以电话或者微信直接沟通。

加我好友,随时为您解答出入境问题